Cape Cod has always been about community. It was that way long before we opened our doors in 1921, and it has remained that way in the 100-plus years since. Central to our sense of community is the incredible work being performed by hundreds of nonprofits that call Cape Cod home. For some, this journey has spanned generations. For others, only a few steps. But for all, it’s about putting the community first.

At The Coop, we recognize that a Cape without you isn’t the same. So, we’ve developed ‘CommunityFirst’ – a suite of banking products and services tailored to fit the needs of nonprofits, big and small.

From money market accounts to certificates of deposit and savings accounts, you can take advantage of flexibility, 100% protection*, and competitive interest rates all designed with the unique needs of a nonprofit in mind.

*Safety and Security. By combining FDIC primary insurance and DIF excess deposit insurance, we are able to provide our depositors full insurance on all deposits, no matter the balance. Visit our FDIC and DIF page for more information.

CommunityFirst Perks

- Available to organizations that qualify for tax-exempt status under Internal Revenue Code Section 501.

- Full suite of products and services including: Checking, Savings, Money Market, Certificate of Deposit, free Online and Mobile Banking1 with Mobile Deposit, free Bill Pay, and free Debit Mastercard®.

- 100% deposit insurance on all balances with the combination of FDIC and DIF insurance.

- Dedicated relationship manager to provide support and tailored solutions to achieve your organization’s goals.

- A variety of lending options with quick decision making and expedited funding following approval

- Free transactions at all branch and Allpoint Network ATMs2

Speak With a Small Business Specialist

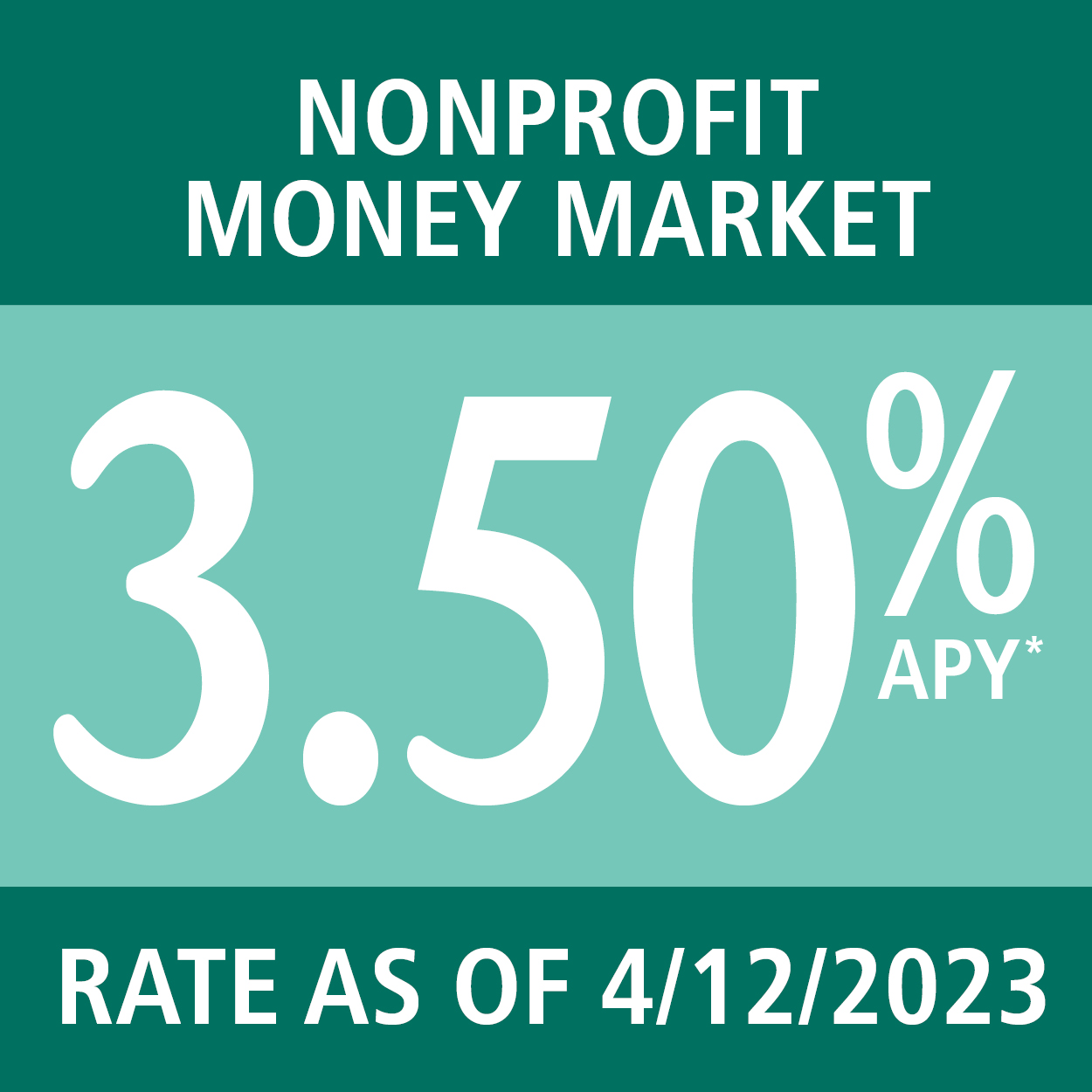

Nonprofit Money Market

Your work is important to our community, and it doesn’t go unnoticed. Preserve your organization’s deposits with the flexibility of a money market account. Enjoy instant access to your funds without transaction limits, a competitive interest rate, and 100% deposit insurance on all balances.

- $10,000 minimum opening balance.

- Interest bearing account with variable tiered rate.

- Interest compounded and credited monthly.

- NO minimum balance requirement to earn interest.

- NO monthly service charges.

Learn More about our Nonprofit Money Market

*All rates and Annual Percentage Yields (APYs) are accurate as of the rate effective date and are subject to change without notice. The Annual Percentage Yield is the rate at which an account would earn interest over a one-year period if the stated interest rate remained in effect and all interest paid on the account was left in the account. Interest is compounded monthly on all accounts. Fees on your account could reduce earnings. Rate(s) may change after the account is opened. Cannot be combined with any other offers. Minimum deposit of $10,000 required to open account.